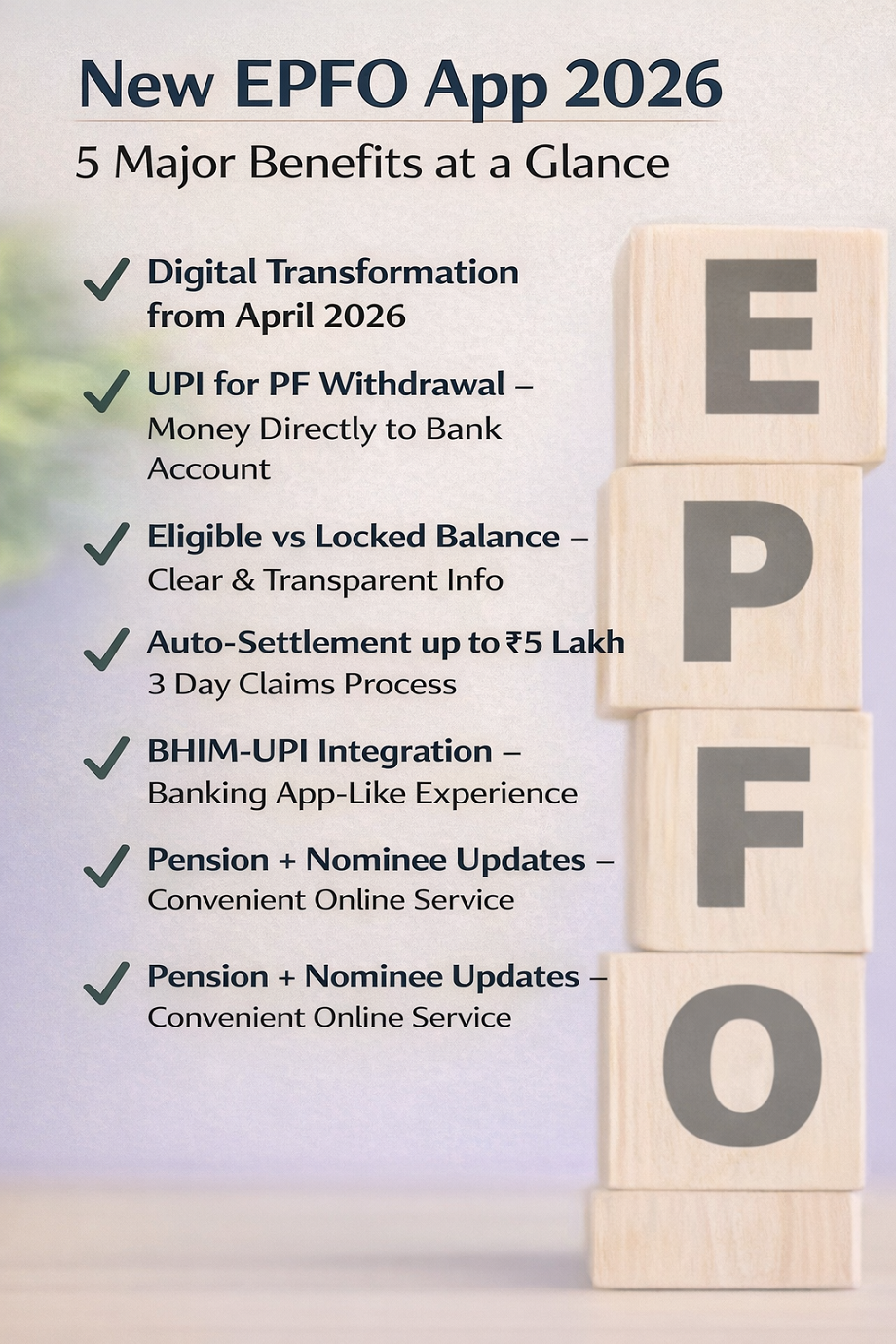

Not just one or two, the new EPFO app offers five major benefits. Learn how to get accurate withdrawal and balance information from home

- bySudha Saxena

- 19 Feb, 2026

In April 2026, EPFO is going to launch a new mobile app, which will provide PF withdrawal through UPI, faster auto-settlement and clear balance information. Yes, now employees will not have to wait long for their PF money.

New EPFO benefits

Starting April 2026, the Employees' Provident Fund Organization (EPFO) is set to usher in a major digital transformation for its millions of account holders. For a long time, the arduous process of withdrawing PF funds, repeated portal logins, document formalities, and weeks of waiting have been a source of inconvenience for employees. Now, starting April, the EPFO will offer ATM withdrawals and is also preparing to launch a new mobile app. This app will offer not just one or two, but five benefits.

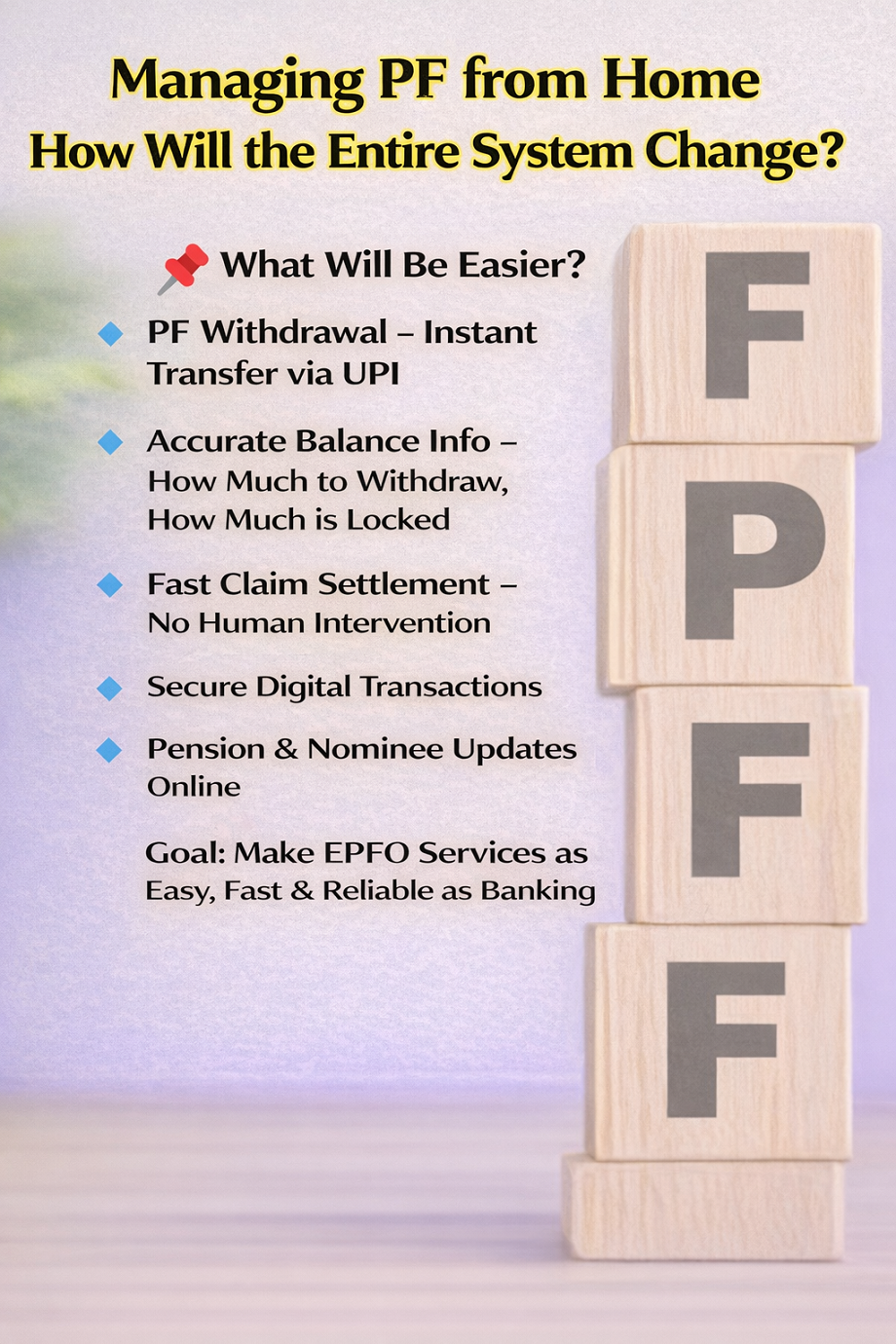

The goal is to make PF services as easy, fast, and transparent as banking apps. This app will allow users to perform almost all PF account-related tasks on their mobile phones, significantly eliminating the hassle of office visits and lengthy processing times.

1- PF withdrawal option

- The biggest feature of the new app will be PF withdrawal through UPI.

- Now, if needed, PF funds can be transferred directly to the bank account.

- The process will be exactly the same as making instant payment through UPI.

- Now you will not have to wait for many days or weeks after the claim.

- The new system will make the withdrawal process faster and easier.

- The government's aim is that employees get their money on time and without any hassle.

2- You will get all the information about the balance

- Clear and transparent balance information will be provided in the new app.

- PF amount will be shown in two parts: Eligible Balance and Locked Balance.

- Eligible Balance will be the amount which can be withdrawn as per the rules.

- However, a part of the total fund will remain locked.

- This locked amount will usually be available only after retirement.

- This will give users a clear idea of the available and safe funds immediately.

- Increasing transparency will reduce any confusion.

3-Auto-settlement system will be upgraded

- Major improvements are being made in the claim settlement process.

- EPFO is preparing to upgrade the auto-settlement system.

- Under this, claims up to Rs 5 lakh will be processed without human intervention.

- The entire process will be completed electronically.

- Such claims can be settled in about three days.

- This facility will be helpful in meeting essential expenses like illness, education, marriage or house construction.

- Employees will be able to get money quickly when needed.

- Besides, the workload of EPFO will also be reduced.

4- Will be integrated with BHIM-UPI platform

- UPI integration will make this app more convenient.

- It will be linked to BHIM and other major UPI platforms.

- Users will get a simple experience like a banking app.

- Login, balance check, transfer and claim will be available at one place.

- There will be special focus on making all transactions secure.

- Digital security and data protection will be given priority.

- This will make EPFO services completely digital and user-friendly.

5-Pension Service and Nominee Update

- Pensioners will now be able to submit digital life certificate (Jeevan Pramaan) online.

- There will be no need to go to the office for this.

- Members will also be able to update their nominee's information through the app.

- This facility will make the process easy, fast and transparent.

Understand the whole thing in few words

Overall, the EPFO's new app, which will be launched in April 2026, is being considered a significant step for employees. Four key benefits make it unique: faster withdrawals via UPI, clear balance information, automatic claim settlement, and a simple digital interface. So, if everything goes as planned, PF-related hassles could be significantly reduced, and employees will be able to manage their retirement funds with greater ease and confidence than before.

Important questions related to the article (FAQs)

Q1 When will the new EPFO app be launched?

It is set to be launched by April 2026.

Q2 Will PF withdrawal be possible through UPI from the app?

Yes, users will be able to transfer money directly to their bank account using UPI.

Q3 Will the claim settlement be quick?

Claims up to Rs 5 lakh can be settled in about 3 days in auto-settlement mode

Q4 How will the balance be displayed in the app?

Eligible Balance and Locked Balance will be displayed separately

Q5 When can the locked balance be withdrawn?

The locked amount can usually be withdrawn after retirement

PC:Zeenews Bussiness/Goverment news