With tax-free income up to Rs 12 lakh, these 5 benefits of the new regime are amazing

- bySudha Saxena

- 19 Feb, 2026

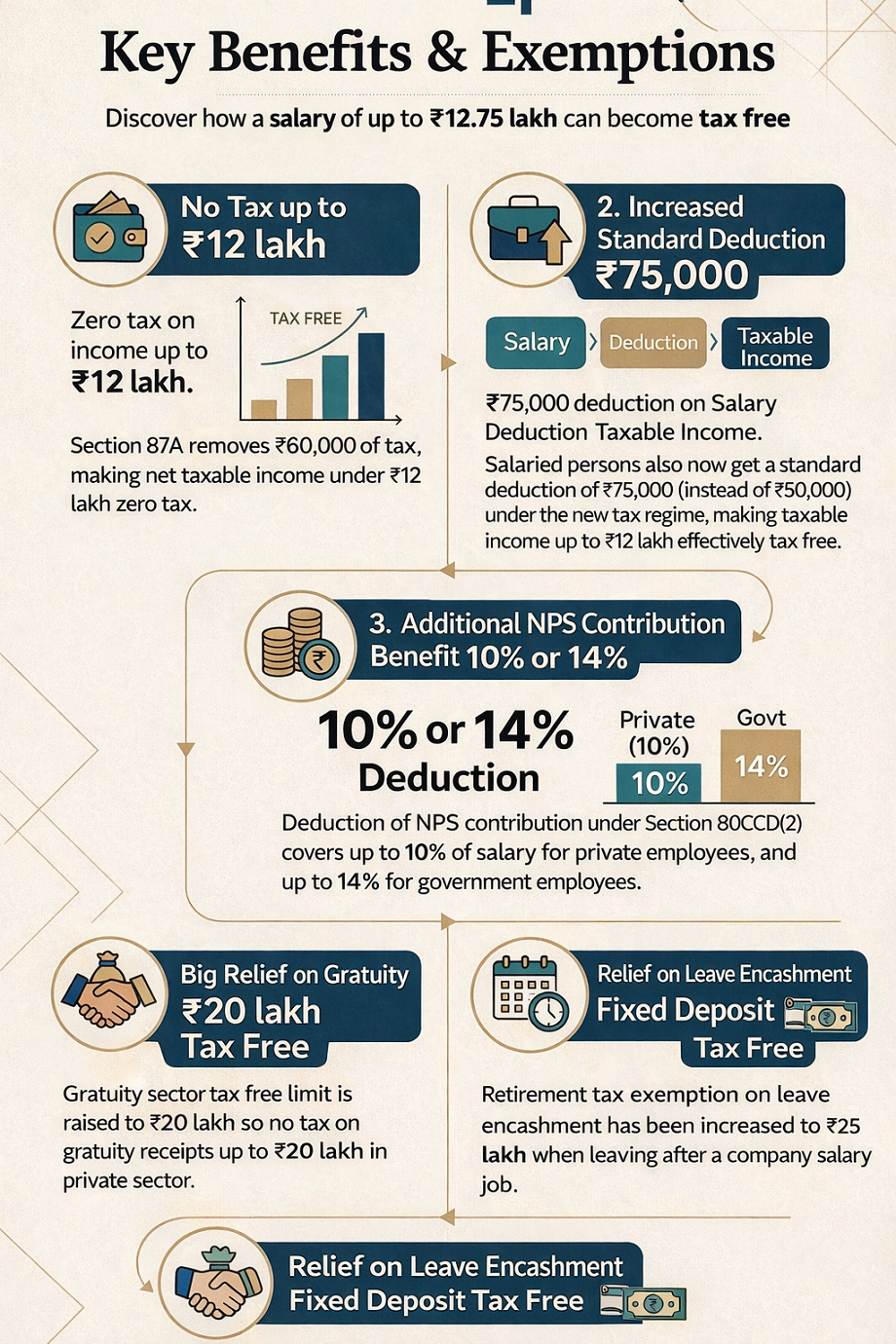

New Tax Regime Benefits: The increase in standard deduction in the new tax regime and the rebate of Rs 60,000 under Section 87A has made it very beneficial for taxpayers.

New Tax Regime Benefits: Middle-class and salaried individuals in India annually plan to reduce their tax burden. Currently, taxpayers believe that the new regime offers fewer tax exemption options than the old one. Although the scope of tax-free income within its tax slabs has expanded, there are no significant investment benefits.

But the new regime offers significant benefits for gratuity and leave encashment, including Section 87A. In this article, we'll cover five key benefits the new tax regime offers taxpayers.

No tax up to Rs 12 lakh

The biggest benefit of the new tax regime is the tax rebate available under Section 87A. This means that individuals with taxable income up to ₹12 lakh now receive a tax rebate of up to ₹60,000. This simply means that if your total income is up to ₹12 lakh, you don't have to pay any tax.

Standard deduction benefits

The standard deduction limit for the salaried class has been increased to Rs 75,000. This means that taxpayers earning up to Rs 12.75 lakh will have a taxable income of only Rs 12 lakh after receiving the standard deduction benefit. This means there is no question of tax liability.

Benefits of NPS

If your company contributes to your NPS account, you can claim a deduction of up to 10% of your salary under Section 80CCD (2), or up to 14% if you are a government employee. This will further strengthen your tax savings.

Big discount on gratuity

Under the new regime, the gratuity received at the time of retirement is completely tax-free for government employees, while those working in the private sector will not have to pay any tax on amounts up to Rs 20 lakh.

Leave encashment

The amount of leave received in lieu of unused leave upon retirement or leaving a job, known as leave encashment, is also tax-free. This can be beneficial for employees who receive a large lump sum after long service.

PC:NDTVINDIA