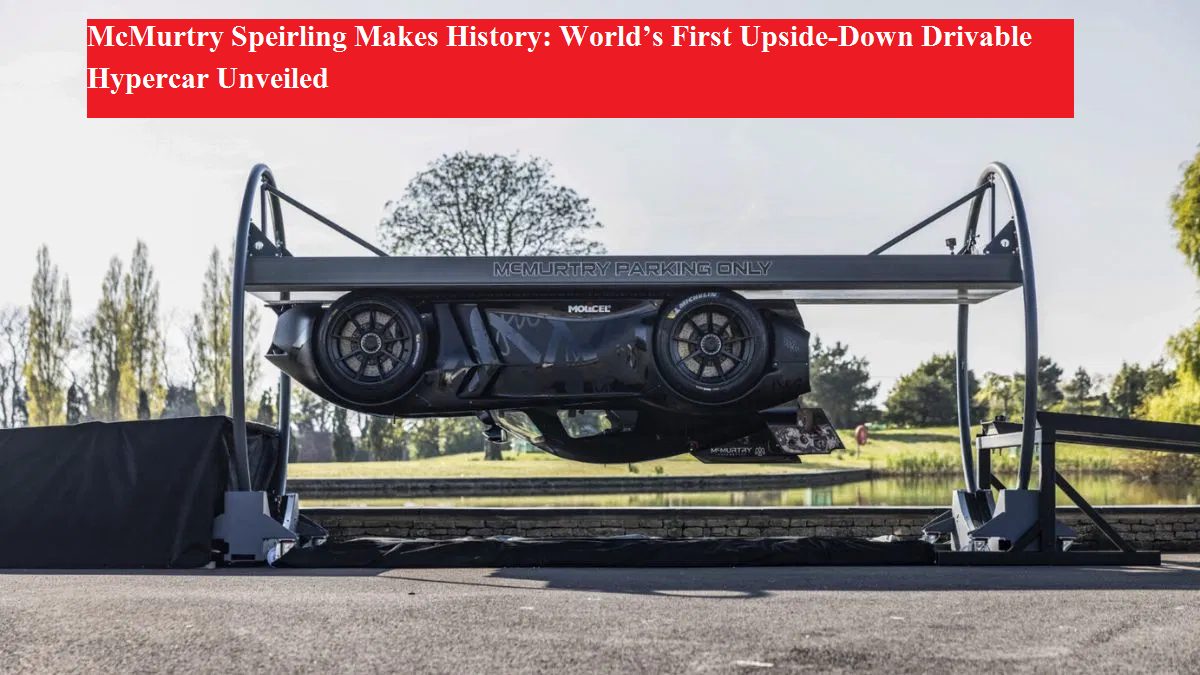

McMurtry Speirling Makes History: World’s First Upside-Down Drivable Hypercar Unveiled

AUTOIn a world where automotive innovation knows no bounds, British carmaker McMurtry Automotive has taken a giant leap into the future with a breakthrough that sounds straight out of science fiction